|

| Bullish engulfing candlestick |

What Is a Bullish Engulfing Pattern?

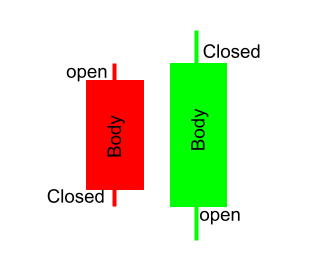

A bullish engulfing pattern is a green candlestick that closes higher than the previous day's opening after opening lower than the previous day's close.

It can be identified when a small red candlestick, showing a bearish trend, is followed the next day by a large green candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick.

|

| Bullish engulfing |

What Does a Bullish Engulfing Pattern Tell You?

A bullish engulfing pattern is not to be interpreted as simply a green candlestick, representing upward price movement, following a red candlestick, representing downward price movement. For a bullish engulfing pattern to form, the stock must open at a lower price on Day 2 than it closed at on Day 1.

If the price did not gap down, the body of the white candlestick would not have a chance to engulf the body of the previous day’s black candlestick.

Comments

Post a Comment